ABLE "New Era of Crypto Finance"

Traditional banks serve as intermediaries and profit from differences between deposit and loan markets (lending-deposit spreads). Currently, cryptocurrency banking businesses provide piecemeal services such as high-yield deposits and loans involving intermediary risks. Current cryptocurrency banking services provide deposits and loans separately rather than linking depositors and borrowers. The services have shortcomings such as inability to provide high deposit interest rates in a sustainable way. The ABLE project will create a system that enables investors and borrowers to share the value generated by eliminating such intermediaries.

The ABLE project primarily aims to apply decentralized blockchain technology to financial and wealth management features; to directly link demand and supply through an account on a peer-to-peer basis; and to establish a reliable system. It aims subsequently to build an in-house decentralized exchange, and then to evolve into a platform on which to develop and use smart contracts for finance and wealth management services.

Why ABLE ?

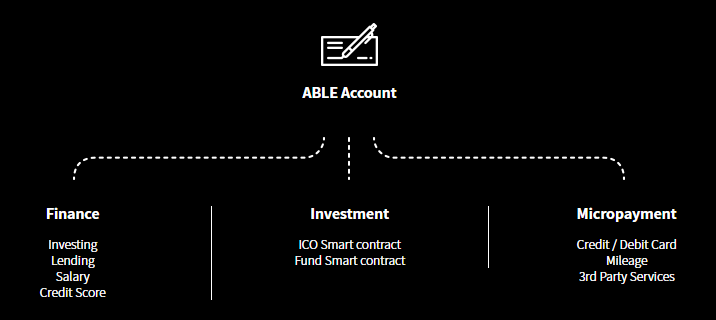

ABLE accounts allowing finance, investment, micropayment upon a single platform.

- ABLE FINANCIAL PRODUCTS

Utilizing various smart-contract frameworks and templates, users can develop cryptocurrency investment products. Using these templates, financial-product developers can create a variety of wealth management and finance smart contracts without having to learn difficult programming languages. Users can access various investment products through the ABLE account.

SMART CONTRACT FOR WEALTH MANAGEMENT

We develop the smart contract frameworks necessary to manage funds, such as trading strategy generators, and portfolio analysis tools. Fund-management service fees will attract investment product developers and create an ecosystem that will:

We develop the smart contract frameworks necessary to manage funds, such as trading strategy generators, and portfolio analysis tools. Fund-management service fees will attract investment product developers and create an ecosystem that will:

- Allow creation of a variety of technical indicator-based trading strategies.

- Create a systematic wealth management environment by providing smart contracts that enable portfolio construction and performance analysis tools.

FINANCE SMART CONTRACT

While the investing-lending matching engine carries out most loans, demand for various financial services will be met through finance smart contracts that include long-term loans, large-amount loans, P2P loans, secured loans, and credit loans. Secured loans, and credit loans based on external ABLE data will be carried out through various integration mechanisms, following the development of the ABLE main network. Initially, ABLE will produce finance smart contracts; then ABLE will gradually provide an environment in which various financial-product developers can produce finance smart contracts based on the finance smart contract framework.

While the investing-lending matching engine carries out most loans, demand for various financial services will be met through finance smart contracts that include long-term loans, large-amount loans, P2P loans, secured loans, and credit loans. Secured loans, and credit loans based on external ABLE data will be carried out through various integration mechanisms, following the development of the ABLE main network. Initially, ABLE will produce finance smart contracts; then ABLE will gradually provide an environment in which various financial-product developers can produce finance smart contracts based on the finance smart contract framework.

- MICROPAYMENT/THIRD PARTY

A big portion of financial activities such as credit-card payments, automatic transfers of utility and service charges, and mileage programs will be integrated into the cryptocurrency space. Extending the scope of practical application based on a variety of partnerships with third-party services, including micropayment, will strengthen the ABLE ecosystem. In the future, a majority of economic activities will be integrated into the cryptocurrency space by cryptocurrency finance.

Roadmap

- 2018

Q1 Pre-Sale

Q2 ICO

Q3 Exchange Listing

Q4 Investment-Loan P2P engine - 2019

Q1 Finance Platform Service

Q2 ABLE Mainnet Development

Q3 ABLE Finance Ecosystem

Q4 ABLE Testnet Launch - 2020

Finance Platform Service

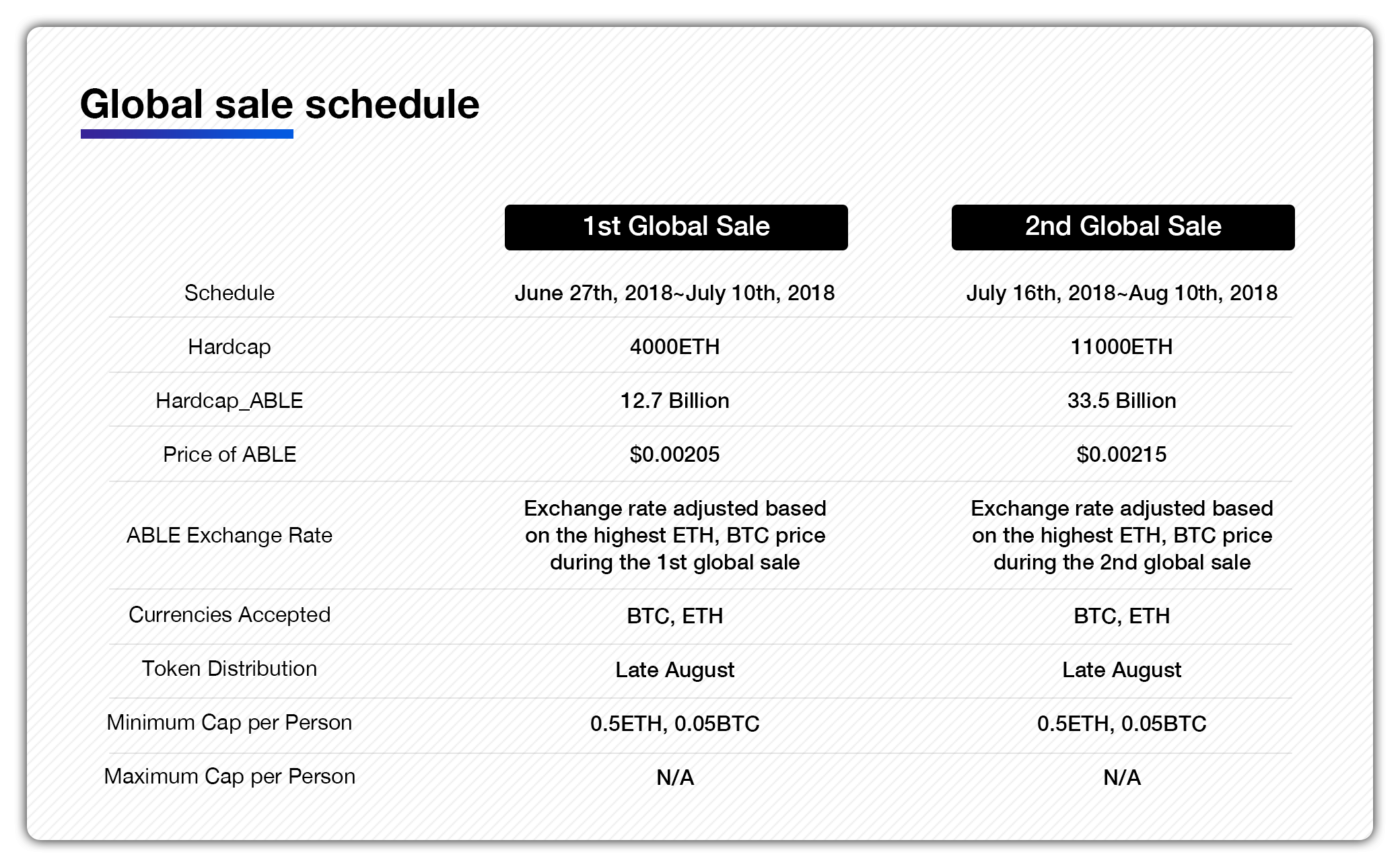

Global Sale

Conclusion

This is just my personal review about the project, if you still want to know more about them, please visit this link below.

DETAIL INFORMATIONS :

Website : https://www.able-project.io/en/index.php?lang=en

Whitepaper : https://www.able-project.io/data/AB_whitePaper_Eng_180502.pdf

Telegram : https://t.me/ABLE_Project_EN

ANN Thread : https://bitcointalk.org/index.php?topic=3159298.msg32659058#msg32659058

Author : bubu4845

MyBitcointalk Profile : https://bitcointalk.org/index.php?action=profile;u=1640802

Whitepaper : https://www.able-project.io/data/AB_whitePaper_Eng_180502.pdf

Telegram : https://t.me/ABLE_Project_EN

ANN Thread : https://bitcointalk.org/index.php?topic=3159298.msg32659058#msg32659058

Author : bubu4845

MyBitcointalk Profile : https://bitcointalk.org/index.php?action=profile;u=1640802

?I used to be very happy to search out this web-site.I wanted to thanks on your time for this excellent learn!! I positively enjoying each little little bit of it and I've you bookmarked to check out new stuff you blog post. online gambling casino

BalasHapus