Lendroid

What is Lendroid?

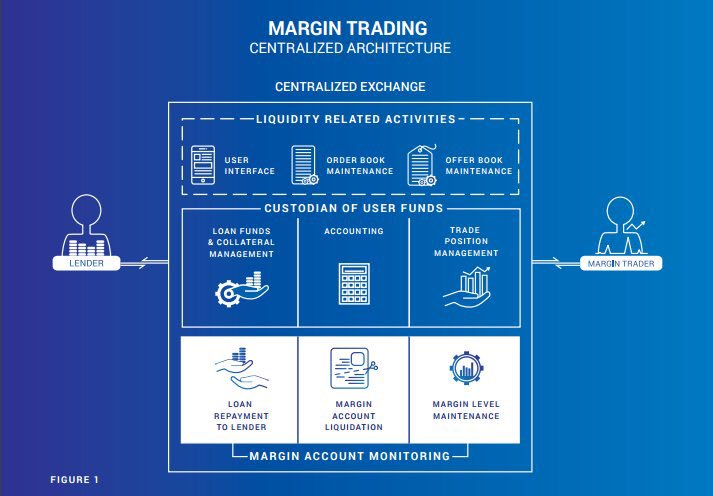

Lendroid is a non-rent seeking, trust-independent, open protocol enabling decentralized lending, margin trading and short selling on the Ethereum blockchain. It aims to solve the shortcomings of centralized exchanges by creating a global shared lending pool, and a symbiotic off-chain infrastructure supported by incentivized participants - Relayers and Wranglers. Simply put, Lenders contribute their offers to the lending pool through relayers, who then match the offers with appropriate traders. The traders can use the borrowed funds to margin trade, make a profit, and repay the lenders.

What is Margin Trading?

If a trader wishes to monetize his confidence in the price of an asset increasing/decreasing, he would take a position by purchasing/selling the asset. If he is extremely certain, he would build a leveraged position by borrowing additional funds from a lender to magnify his profits.

How does Lendroid enable lending and margin trading?

Lending - A borrower pledges digital assets into an escrow account, with specific terms for the loan set in a smart contract. If the lender’s and borrower’s terms match, the smart contract is executed, locking in the collateral and releasing the funds to the borrower funds. If the loan obligations are satisfied by the borrower, his collateral is unlocked automatically. If the borrower defaults or the collateral drops below the agreed loan to value, the collateral is liquidated. Margin trading - A margin trader starts by depositing collateral. The trader is allowed to borrow up to a certain leverage to the point where the margin level is greater that the initial level (set through community governance). The borrowed funds come from the shared lending pool to which the lenders can submit offers. With the borrowed funds, the trader interacts with order-books to calibrate positions to reflect expectations from future price movements. Once the traders feel it’s time to unwind their position, the trader once again interacts with the order book. If the trader made a profit, he can repay the lenders and withdraw the profit along with his collateral. If a loss is incurred, the trader is expected to deposit the difference to compensate for the losses, repay the loans in full and only then withdraw collateral. If the account reaches liquidation levels, the wranglers step in and take over the account/positions.

The lender broadcasts the loan-offer to all decentralized exchanges (off-chain action, analogous to a Maker order from the 0x protocol). The lender deposits the funds into the Funding Account of the Lendroid Smart Contract System. To lubricate the inherent processes, the lender deposits some LST (Lendroid Support Token) meant for the Relayer at the end of the loan period. Some he deposits for the Wrangler in the event that it was he who identified the Margin Account at liquidation level and helped close the loan. The LSTs required for these processes are locked in at the time of initiation. If there is not enough LST for these processes, the loan is not initialized.

Lendroid Support Token

The Lendroid Support Token, or LST, is the native token of the Lendroid protocol. Participation requires a user to possess LSTs. Those that do not are incentivized to earn LSTs by engaging in activities that contribute to the health of the ecosystem. As with all ERC20 tokens, LSTs will be tradeable following the crowd sale (details in annexure). The LST has been envisioned for a three-fold objective: to lubricate process and drive utility on the protocol; to incentivize participation; to empower governance. As a non-rent-seeking protocol, self-sustenance can be achieved only if the LST is tied to value creation.

UTILITY TOLL

To quote Ethereum Foundation advisor William Mougayar, ““...there needs to be a specific linkage between user actions and the resulting effects of those actions on the overall value to the organization.” The LST enables utility and lubricates process on the protocol. There are four players on the protocol, two of which provide utility - the Relayers and the Wranglers - and two others who avail of these utilities and participate to maximize profits - the Lenders and the Borrowers/Margin Traders. On Lendroid, the toll for service or utility providers on the protocol is baked into the system. Consider the following table. When floating an offer, for instance, the Lender deposits LST fees meant for the Relayer as well as for the Wrangler. When the Margin Trader avails the loan, he too deposits his toll for the Wrangler and the Relayer. The toll is paid only when the loan is closed, and only pro-rata depending on how long the loan was open. However, the deposit is always made in full - the maximum possible fee for the full loan term.

Lendroid Vision

LEND AGAINST ANYTHING THAT CAN BE TOKENIZED

We believe that assets in the future will be tokenized and tradeable globally in real time. We believe Lendroid holds limitless applications in marketplaces across industries. In this whitepaper, we elucidate a protocol on the Ethereum blockchain that makes a founding attempt at bringing together lending, leveraged margin trading and short selling, onto a single protocol – decentralized, trust-independent, non-rent-seeking. The protocol seeks to overcome ‘on-chain’ limitations of inadequate computational power, latency and impractical gas cost by creating a symbiotic off-chain infrastructure supported by incentivized participants. The native token keeps the network operational, fuels the utility layer of the protocol and offers security to community governance. An important goal of the protocol is to nurture a decentralized, global, shared lending pool, with far-reaching applications beyond just the use case of margin trading. The modular and extensible nature of the protocol could make it the basis for all lending-related use cases for an increasing number of assets that are being tokenized across industries. The protocol’s inherent non-partisanship, where no single group of stakeholders draws arbitrary benefit, is inspired by 0x.

Lendroid Support Token

Rate: 1 ETH - 48 000 LST

Bonus - 25% of TGE tokens reserved for pro-rata distribution among contributors who optionally vest for

2 years.

Hard Cap - 5000 ETH

2 years.

Hard Cap - 5000 ETH

Token Supply - 12 000 000 000 LST

Released in Public TGE - 240 000 000 LST

Accepted Currency - ETH

Roadmap to the Lendroid Token

Detail Informations :

Website : https://lendroid.com/

Whitepaper : https://lendroid.com/assets/whitepaper.pdf

Twitter : https://twitter.com/lendroidproject

Telegram : https://t.me/lendroidproject

Telegram Bounty : https://t.me/joinchat/GJ8FDBGLY_noGHSBieE8lQ

Bitcointalk Profile : https://bitcointalk.org/index.php?action=profile;u=1640802

Komentar

Posting Komentar