GBX-Gibraltar Blockchain Exchange

Reality about any extraordinary thought is that it is effectively comprehended and that its need bodes well. This is the situation of the Gibraltar Blockchain Exchange (GBX).

The Gibraltar Stock Exchange

The primary premise of the Gibraltar Stock Exchange is the quickness in the administration of quotations, whatever the item you pick, and also costs that are even lower than those enlisted in Luxembourg and Switzerland.

The Gibraltarian stock trade is led by Marcus Killick, who for a long time headed the Financial Services Commission of Gibraltar, a position he cleared out last February and touched base in the wake of doing different obligations in the budgetary part of the Isle of Man and the islands Alligator.

Notwithstanding this budgetary instrument, the production of the Chamber of Commerce, the formation of the Investment Bank of Gibraltar, with 19 million euros of open capital at its introduction to the world, are alternate legs of the drive to the monetary part that means to do the administration of Picardo. This substance will supplant Barclays and will offer administrations to retail customers as a separating component.

The team at the Gibraltar Stock Exchange (GSX), the parent company of GBX, had been studying blockchain technology for some time. In November of 2015, they began to plan the “Crypto Securities Exchange”. In mid-2016, the GSX admitted to include in its regulated Main Market one of the first Bitcoin Asset-Backed Securities (ABS) in the world.

Soon after, the team focused on the emerging world of token sales. It was a market that was quickly recognized as lacking clear rules and practices, investor protection and sufficient processes to examine the claims of issuers. In his experience, the market lacked government. Without it, this promising sector would never attract sustainable institutional investments, or the kind of resources needed to ensure long-term growth.

The need for a clear and professional type of structure is what GSX saw, understanding that now is the best opportunity to contribute and for this it launched a new subsidiary: the GBX.

His plans, however, extend far beyond the creation of a chip selling platform and the exchange of cryptocurrencies. The GSX GROUP intends to build a complete fintech ecosystem that offers all possible services and the support that issuers, entrepreneurs and investors need within a transparent and regulated framework.

So, how does it work?

1. The role of Gibraltar as a jurisdiction is very important.Gibraltar is a great support for blockchain companies. In October of 2017, the Government of Gibraltar, after a long period of consultation, published the Regulatory Framework for Distributed Accounting Technology or “DLTRF”. As of January 1 of the year 2018, it is in force. It is a non-prescriptive, rule-based regulatory format that allows companies the flexibility they need to work with a new technology without committing to robust standards.

The DLTRF standard recognizes some very important points that others could not understand in the past. It is not possible to regulate the cryptocurrencies themselves, but it is possible and reasonable to establish standards for individuals and companies that act on behalf of a third party.The creation of this framework means that the Government of Gibraltar is taking measures to help protect investors by ensuring that companies operating in the territory are legally fit and adequate.Therefore, GBX is fully compatible with DLTRF. It intends to be the first exchange under the supervision of the Gibraltar regulator and obtain authorization from the regime.

2. The most important thing to understand is the GBX listing process.GBX establishes a clear listing process to ensure that applicants on the list follow its rules.

First, a project must designate a Sponsoring Firm. The sponsoring firms are organizations that have been licensed by GBX to bring lists to the market.They act to ensure that applicants on the list do not limit themselves to praising the rules, but that they actively comply with the letter and spirit of the rules.These Sponsors, ensure that a project is eligible to launch a token sale and a list in GBX, advise on how to comply with the rules and work with a project to complete and submit your application.The sponsoring companies also participate in a stakeout mechanism. They must have a portion of the tokens they bring to the market.After inclusion, the sponsoring companies are also responsible for ensuring that the projects comply with their ongoing obligations, which mostly have to do with the disclosure of information.It can be said that the sponsoring firms support the initiatives that lead to the market and their commercial reputation is at stake.All of this is designed to help ensure that projects arriving at GBX act in accordance with a higher standard of business practice and make a sincere effort to do so.

3. The role of the sponsoring companies of GBX is essential to guarantee the well-being of the market.

As such, any company aspiring to become a GBX sponsor must demonstrate the quality of its management team and its solid experience in the blockchain.An important set of things to consider are the expectations that the GBX will have of token buyers.It is important that the sales of tokens released in GBX and the projects behind them comply with a higher standard. We work to ensure that the products offered are of superior quality, but it is also true that the issuers and the GBX itself have some expectations as to who buys the tokens.The Know Your Customer or “KYC” and Anti Money Laundering (AML) procedures will be implemented in GBX. In the world in general, in 2017, we proved that the source of the funds was not necessarily a problem, but from now on, at GBX, symbolic buyers will have to prove who they are and reveal where their funds come from.

As such, any company aspiring to become a GBX sponsor must demonstrate the quality of its management team and its solid experience in the blockchain.An important set of things to consider are the expectations that the GBX will have of token buyers.It is important that the sales of tokens released in GBX and the projects behind them comply with a higher standard. We work to ensure that the products offered are of superior quality, but it is also true that the issuers and the GBX itself have some expectations as to who buys the tokens.The Know Your Customer or “KYC” and Anti Money Laundering (AML) procedures will be implemented in GBX. In the world in general, in 2017, we proved that the source of the funds was not necessarily a problem, but from now on, at GBX, symbolic buyers will have to prove who they are and reveal where their funds come from.

For many projects, anonymity was not a problem to raise funds during the ICO itself. Later, many of these same projects are in difficulties when it comes to more daily operational financial relationships. Many banks will not do business with them because they themselves can not prove the source of the funds and because many of the people to whom they sold tokens are anonymous.

In the same way that GBX expects transparency from the projects that launch the sales of tokens, it will also demand transparency from the buyers. GBX intends to offer the best service to both parts of the market.

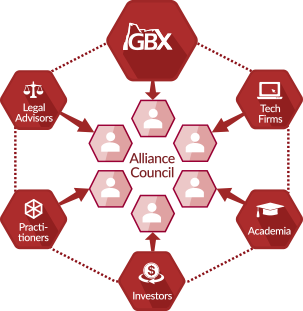

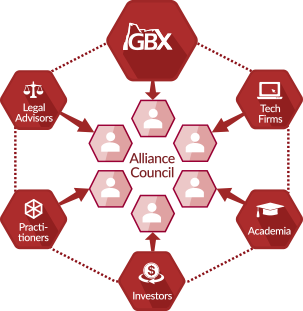

4. The structure and processes of GBX are GBX Alliance and GBX Alliance Council.

GBX expects scrutiny and transparency when it comes to the participants in the market, but also of itself.

The GBX Alliance is a membership body composed of leading thinkers, lawyers and professionals throughout the blockchain industry. Members are invited by the leadership of GBX to help ensure that the exchange reflects the best in thought and practice, and that the GBX proposal never weakens or falls behind the needs of the participants.The importance of the GBX Alliance in the configuration of government and GBX rules is further highlighted by the election of the members of the GBX Alliance Council. The GBX Alliance Council will directly advise the GBX and contribute to its decision-making processes and the development of its ethos.What has been exposed so far, describes the most important aspects of the way in which the GBX intends to operate. The Gibraltar Stock Exchange and the GSX Group in general are also participating with the blockchain community through a variety of other initiatives.

For example: GSX has created the Blockchain Innovation Center (BIC), a center to encourage the development of new technologies, which helps bring together people with ideas for new projects, and finance them if appropriate.He has also joined the Ethereum Enterprise Alliance and Hyperledger, where he can interact with a wide range of world leaders in the development of blockchain technology.GBX is preparing to deliver best practices both in its operations and in its ideas, in a regulated environment, raising standards for the entire industry.

For example: GSX has created the Blockchain Innovation Center (BIC), a center to encourage the development of new technologies, which helps bring together people with ideas for new projects, and finance them if appropriate.He has also joined the Ethereum Enterprise Alliance and Hyperledger, where he can interact with a wide range of world leaders in the development of blockchain technology.GBX is preparing to deliver best practices both in its operations and in its ideas, in a regulated environment, raising standards for the entire industry.

Detail Informations :

Website : https://gbx.gi/

Whitepaper : https://gbx.gi/token-sales/GBX-Whitepaper.pdf

Twitter : https://twitter.com/GibBlockEx

Telegram : https://t.me/GBXCommunity

ANN : https://bitcointalk.org/index.php?topic=2684176.0

Bitcointalk Profile : https://bitcointalk.org/index.php?action=profile;u=1640802

Whitepaper : https://gbx.gi/token-sales/GBX-Whitepaper.pdf

Twitter : https://twitter.com/GibBlockEx

Telegram : https://t.me/GBXCommunity

ANN : https://bitcointalk.org/index.php?topic=2684176.0

Bitcointalk Profile : https://bitcointalk.org/index.php?action=profile;u=1640802

Komentar

Posting Komentar