DEBITUM NETWORK

Introduction

Loans called credit now is an absolutely essential factor for the major startup and continuing of a modern day business, especially those so called SME ( small or medium- sized enterprises) businesses, but do you know that around 70% of all those SME businesses in the evolving markets are deprived of the access to credit. It is estimated the current credit gap to be a whopping $2 trillion. Mainly this has been caused strict regulations put forth by central banks and which urges local money lenders and finances to stop funding small businesses. One more key problem is the lack of trust between lenders and borrowers. This issues ultimately lead to blockage of funds to SMEs which stops them from achieving their full business potential.

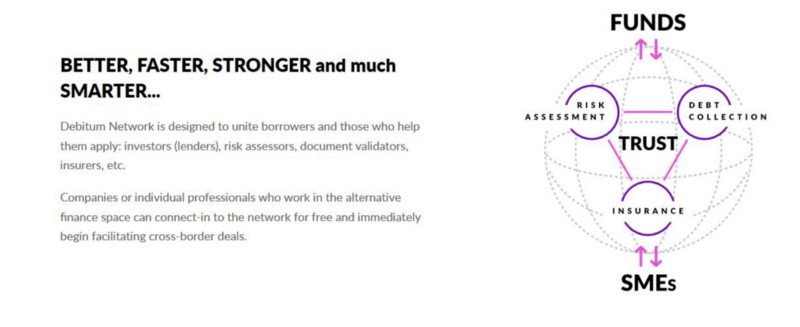

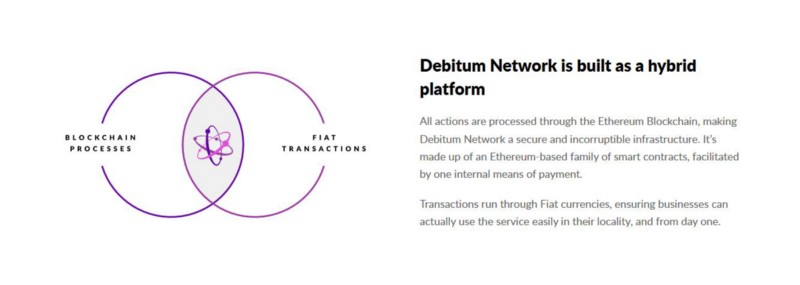

The Debitum network aims to solve this dilemmas with a revolutionary new decentralized ecosystem and a reliable and trustful community which links investors, money lenders service providers, and borrowers in an effective way. The crafty design of the Debitum Network allows it to become self-sustainable in long run. DEB tokens will be used as the copyrighted cryptocurrency of the Debitum Network, whereas interest and loan principal payments will be transacted via Fiat currencies. Debitum Network is different from other platform, it takes a hybrid approach. Keep in mind that the Debitum network is hybrid system which perfectly synchronizes Ethereum Blockchain technology where all the transactions will be done using Fiat currencies making it easier for any business around the globe to access since cryptocurrencies are too volatile most local businesses would prefer to deal with loan payments.

The Debitum Network stands on three strong pillars. Them being true decentralization, a system based on a hybrid concept linking crypto and fiat, ultimately the third pillar is the trust contributors place upon them.

How does the Debitum Network work?

Imagine yourself the owner of a timber company in Brazil and you would be so much willing to export your production to the UK. Yet you have no money for global expansion of your business at the present moment. So you sell your production on the cheap way to John, well John is simply a middleman who’s doing business in the UK. You decide enough is enough, you have to put an end to the havoc you are causing for yourself, but how? Suddenly an idea struck your mind like lightning, you remember the news you heard of a platform which lends money without causing you any frustration or waste of time. Ahhh…. The Debitum Network.

First off you contribute to the Debitum Network by taking part in the token sale and receive your DEB tokens. You can only do this by funding with Ethereum because the platform is backed by Ethereum smart contracts. Then you need to register to the Debitum Network and put forth a loan application of 15,000 USD with an interest rate of just 11% keeping your wooden warehouse as a collateral (like pawing a necklace in a pawn shop, the necklace is the collateral). An ample of investors from Europe and North America agrees to finance you providing you with the loan you have been waiting so long for, the 15,000 USD to achieve full business potential. You are happy to see your business growing like a rising escalator. So after you are successful in establishing your business empire in the UK you easily payback the loan with the interest to the investors. It’s not only you who benefit from the Debitum Network but the network grows with you. When you contribute to the Debitum Network it will help make Debitum’s vision of easier access to credit for businesses worldwide and since there is a limited number of tokens available, the price of the tokens is expected to rise significantly making it a potential goldmine for crypto fanatics.

DEB (Debitum Token)

Debitum’s vision is to create a self-sustaining, spontaneous, commercial ecosystem which provides small and upcoming businesses easier access to credit. The Debitum network is backed by the DEB token making it the only cryptocurrency that you can pay for services in the platform. Only those with DEB tokens will be granted access to loans and various other services. The value of the token increases since the DEB token is the only token you trade within the platform and you need a certain amount of DEB to access services.

Investors and money lenders are expected to be in the Debitum Network for a long term as for the huge amount of potential investments. On contrast borrowers esp owners of small business are expected to be on the platform for a short period of time, since the can soon receive a loan and grow their business. As more and more investors and borrowers use the platform the price of DEB token is expected to surge.

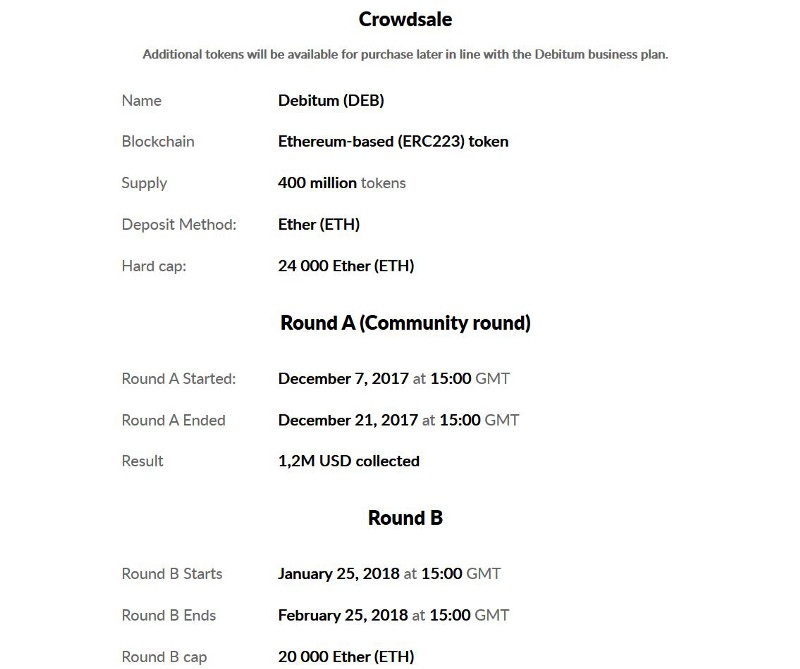

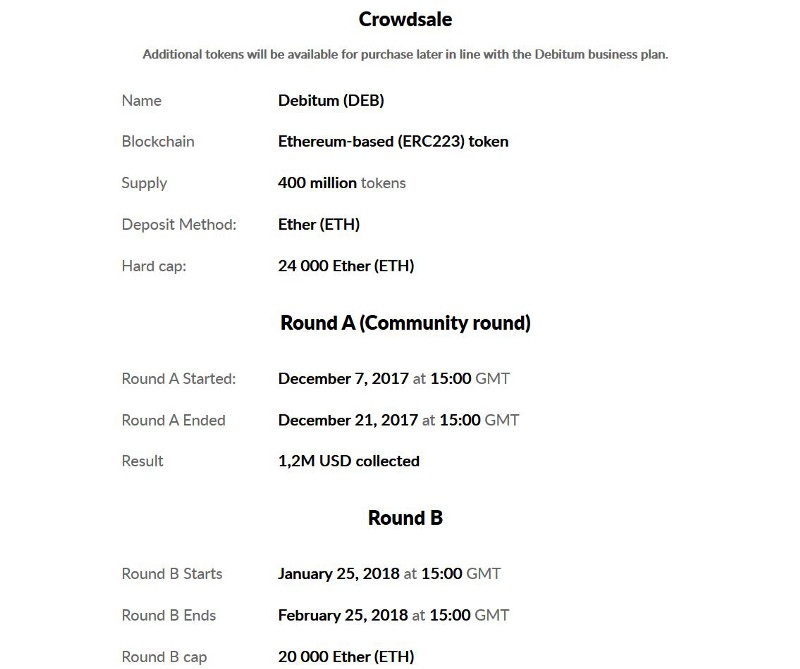

The platform is ready to be launched in 2018. The Crowdsale was done to raise funds in two separate rounds. The Round A was launched in October 2017 and has raised over 1.2$ million. The Round B has already started and was live at the time of writing this article.

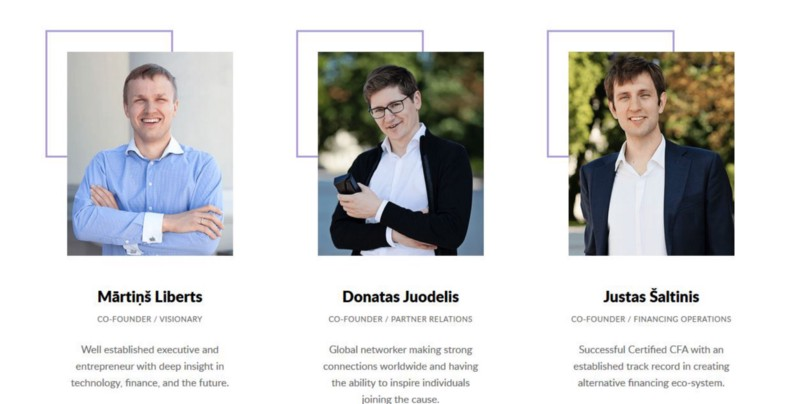

Leadership Team

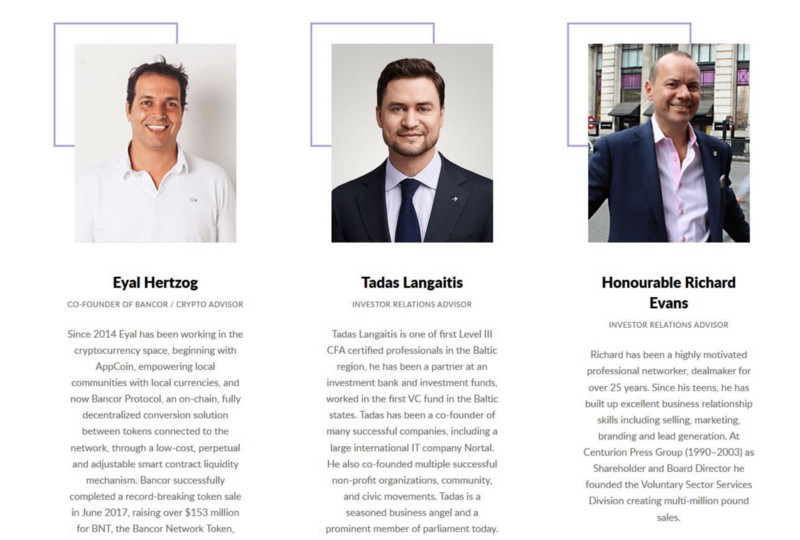

Advisory board

Detail Information :

Website : https://debitum.network/

Whitepaper : https://debitum.network/whitepaper

Ann Thread : https://bitcointalk.org/index.php?topic=2321064.0

Facebook : https://facebook.com/DebitumNetwork

Twiter : https://twitter.com/DebitumNetwork

Bitcointalk Profile : https://bitcointalk.org/index.php?action=profile;u=1640802

Komentar

Posting Komentar